Included in collection: Entrepreneurship

What is Entrepreneurship? Lecture

Entrepreneurship refers to the process of identifying, and then setting up a business to leverage a business opportunity. The entrepreneurial process involves some type of innovation, this may be product innovation or process innovation. Product innovation is the development of a new product category or improvements in an existing product. An example of entrepreneurship with product innovation was Dyson’s development of a bagless vacuum cleaner. Process innovation is where there are changes in the way a product or service is created or provided, this may not change the final output, but the way that output is achieved. An example of entrepreneurship with process innovation was seen with Bezos setting up Amazon, the process was the sale of books, with the innovations being the medium through which the book was sold.

The individuals developing or identifying the business opportunity and setting up the new businesses after are referred to as entrepreneurs. Entrepreneurs are willing to accept the risks associated with setting up a new business.

1. Definitions and Theories

1.1 Definitions

There is no single universally accepted definition of entrepreneurship or the entrepreneur. The term entrepreneur is derived from the French word entreprendre which means ‘to undertake’. In the context of business, this is used to relate to the starting if a new business. Many generic definitions of an entrepreneur describe them as an individual who set up businesses, assuming the risk with the aim of generating a profit. This generalised definition may be criticised as too ambiguous. A more specific definition has been developed by Professor Howard Stevenson who defines it as

“The pursuit of opportunity without regard to resources currently controlled”

- (Stevenson, 1999, p.10)

The key terms in this definition are pursuit, opportunity, and resources currently controlled. Pursuit is undertaken in a determined and often relentless manner. The entrepreneurs often perceive the presence of a short window of opportunity, which supports the motivation to act and leverage their idea. Opportunity refers to the entrepreneurs’ idea or innovation. The reference to being without regard for resources currently controlled is indicative of the limitations entrepreneurs face when starting out with entrepreneurship undertaken without conceding to the constraints of limited resources. This often requires innovative approaches to business to maximise the benefit from resources; this is often referred to as entrepreneurial stretch.

Just as there are differing definitions, there are also differing theories regarding how and why entrepreneurship exists.

Get Help With Your Business Assignment

If you need assistance with writing your assignment, our professional business assignment writing service is here to help!

1.2 Economic Theories

Economic theories are the most common approach to entrepreneurship theory. Three main economic approaches exist; classical, neo-classical theory, and the Austrian market process (AMP). In all cases the development and continuance of entrepreneurship is based on the way on which economic value can be obtained through the creation of the new business or bringing of the new idea to market.

1.2.1 Classical Theory

Classical economic theory support the ideals of free trade, specialisation, and competition. Cantillion developed his entrepreneurial theory in the 18th century based on classical economics, and observations of the industrial revolution, hypothesising the role of the entrepreneur as an agent able to direct and create value bringing together land, labour and capital.

While this approach is supported by evidence of entrepreneurs starting businesses during the industrial revolution to leverage new opportunities facilitated by the changes in technology, it can be criticised as it does not explain how entrepreneurs were able to create such upheaval in the economy during the industrial age.

1.2.2 Neo-classical Theory

The neo-classical theory manifested as a result of the criticisms directed at the classical model. In this model the role of the entrepreneur is argued as explainable merely by the model of pure exchange, with the exchange reflecting optimal levels of production, taking place in an economy that was presented as closed. This model assumes there is perfect competition in an economy which is made up of the participants making exchanges. This model states that the impetus for entrepreneurship can be explained by the presence of diminishing marginal utility and the process of exchange.

There are several criticisms of this model. The first is that the model only uses aggregate demand and does not account for the individuality of different entrepreneurial ventures. Additionally, this approach is based on the assumption of perfect competition, the belief market actors will behave rationally, including rational allocation of resources, which does not always occur, and makes no allowances for the future value of innovations

1.2.3 Austrian Market Process

The Austrian Market Process (AMP) is able to deal with some of the issues seen in the neo-classical model. This model is influenced by Joseph Schumpeter and focuses on the way people act in the economy of knowledge. Schumpeter believes that innovation and the creation of new things are drivers for economic growth, as such entrepreneurs is a driver within a market based economy.

This model is more dynamic than either the classical or the neo-classical, and allows for a dynamic environment in which knowledge moves around the economy and accepts the presence of information inequalities. This overcomes the assumption of perfect competition in the neoclassical approach, with the ability of entrepreneurs to benefit from imperfect knowledge. However, it is not a perfect explanation; it does not allow for situations where there may be antagonist competition, it does not allow for entrepreneurship which occurs in non-commercial/public sector scenarios situations and without competition, as it is assumed competition will always be a driver.

1.3 Sociological Theories

Sociological theories of entrepreneurship examine the relationship between social contexts and entrepreneurship. Four social contexts have been identified; social networks, life course stage, ethnic identification, and population ecology.

1.3.1 Social Networks

Social networks may help promote entrepreneurship through the building of relationships and bonds that are characterised by trust, rather than opportunism. In this context, entrepreneurs may find support within social networks, without the need for opportunism.

1.3.2 Life Course Stage

The life course stage incorporates analysis of the life situation as well as the characteristics of an entrepreneur at the point they chose to pursue entrepreneurship. The idea is that the life experiences of an individual will influence their decisions to pursue entrepreneurship, with entrepreneurs often deciding that they want do something meaningful with their lives.

1.3.3 Ethnic Identification

Ethnic identification proposes the idea that an individual’s background is a major influence on the entrepreneurial decision. An individuals’ social background will impact on their expectation and how far they are willing to push themselves. For example, members of marginalised groups may be motivated to break boundaries due to a disadvantaged past, seeking to improve their life.

Population ecology draws on environmental factors which are influential on the ability of new businesses to set up and survive. These may include the legislative environment, the political system, competition and industry structure, and the type and power of customers.

1.4 Anthropological Theories

Anthropological theories of entrepreneurship look to how the community values, customs and beliefs impact on the decision for an individual to pursue entrepreneurship. The implication is that culture will impact on the decision to set up a new business, and the decisions of customers to patronise the new business.

The approach may also be referred to as the cultural entrepreneurship model, as it draws on cultural influences to explain the manifestation and response to entrepreneurship. This is supported by research from different areas of business, such as Hofstede’s cultural dimensions model which examines cultural traits of different countries/cultures. One of the Hofstede’s dimensions is risk avoidance, which is negative correlated with entrepreneurship.

1.5 Opportunity-based Theories

Howard Stevenson and Peter Drucker advocate the use of the opportunity based approach towards entrepreneurship. This is a rather broad concept, where entrepreneurs take advantage of opportunities they identify. This theory may be contrasted to the ideas of Schumpeter and AMP; instead of believing entrepreneurs cause change, the opportunity based model argues entrepreneurs merely exploit opportunities which emerge due to change, such as customer tastes or technological change. In this model entrepreneurs seek out changes, so they can respond to that change seeing it as an opportunity to be exploited. It is this approach that leads to the definition provided in section 1.1.

1.6 Resource Based Theories

The resource based theories of entrepreneurship state that access to resources will be a predictor of opportunity based entrepreneurship. The approach recognised many different types of resources, including, but not limited to, financial, social, and human resources.

1.6.1 Financial Capital and Liquidity

There is significant empirical research which demonstrates more firms are set up by individuals who have access to capital. Those with capital are better placed to access the resources that are required to develop innovations and pursue opportunities. However, while there is support for this idea, there is also empirical support demonstrating that a lack of access to resources encourages greater levels of innovation, which is known as ‘entrepreneurial stretch’.

1.6.2 Social Capital

Entrepreneurs are already part of larger social networks, made up of family, friends, and acquaintances. It is argued that social connections may help to overcome lack of access to other resources, such as capital, by support which may be garnered from the network. This is very similar to social networks discussed in section 1.3.1.

1.6.3 Human Capital

Human capital is also required to leverage opportunities. Human capital may be categories by two dimensions; knowledge which can be associated with education and experience. Education and experience are positively associated with the emergence of entrepreneurs, they are also a resources an entrepreneur may need to aid with the business set up and development; employees may be needed, with relevant skills and knowledge.

Think of a new product or service that has come onto the market recently, or a product you have seen on a TV program such as Dragons Den. What entrepreneurial theories may be applied to the new product/service and why?

Hint; more than one theory may apply.

2. Economic Significance

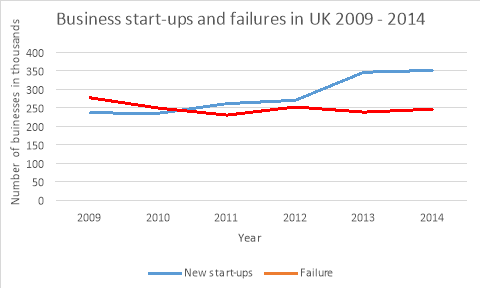

The presence of entrepreneurs in an economy provides the potential for economic growth, providing jobs and supporting gross domestic product (GDP). Over the last few years there has been an increased level of new business start-ups up in the UK, which exceed the level of business failures. Figure one below shows the pattern of start up’s compared to failures in the UK using figures from the Office for National Statistics

Figure 1; Business start-ups and failures in UK 2009 - 2014

With this level of activity, it is unsurprising there is a significant economic impact.

2.1 Revenue Generation

Entrepreneurs start businesses which generate income. While early years of entrepreneurship may result in net losses, research undertaken by the University of Liverpool and Manchester Metropolitan University found that an entrepreneur who had been trading full time in their business would draw a mean of £12,440 after five years, showing a trading profit of just below £10,000 (Centre for Enterprise, 2016). The mean profit levels have also been found to rise consistently until years 9 or 10 (Centre for Enterprise, 2016). However, while there are many smaller organisations set up, there are also many firms started which generate high revenues.

Statistics from the Global Entrepreneurship Monitor (GEM) UK 2014 report demonstrate there is a high level of revenues generated by entrepreneurial businesses. 8.6% of all businesses’ in the UK are early-stage entrepreneurial, these are entrepreneurial business less that have been trading less than 42 months. Notability the proportional contribution to the UK economy is greater than many other countries. For example, in France early-stage entrepreneurial only make up 5% of all businesses’.

Research by Deloitte supports the importance, by showing high revenues are generated. IN 2015, it was estimated the total direct value of entrepreneurs to the UK economy was £18 billion. The indirect impact will be much greater as money earned is spent and supports economic growth through the multiplier effect. The profits earned and wages paid will also generate taxes for the government.

2.2 Job Creation

Just as entrepreneurs generate revenues creating a positive impact on the economy, they also generate jobs. In a recent report by the World Economic Forum it was estimated that 1% of the world’s new start-ups generate 40% of all new jobs.

In the UK, according to the Economic & Social Research Council, SME’s, many of which are, or where, entrepreneurial, account for 60% of all the jobs in the private sector. Rising numbers of new businesses and entrepreneurs will increase this further.

3. Traits

Psychological studies have sought to identify common traits, or characteristics, that are found in entrepreneurs, and may be used to explain how or why individuals become entrepreneurs.

3.1 Trait Theory

Trait theorists believe individuals have enduring, stable, personal qualities or characteristics which define their character. Trait theories applied to many areas of business, including leadership studies as well as research concerning entrepreneurship. However, it has been argued that there is no singular set of traits or characteristics which will inherently define an entrepreneur. Instead, there some traits or characteristics are more likely to be associated with entrepreneurship. Various researchers have identified a number of traits positively associated with entrepreneurship include the following.

- High levels of creativity and innovation

- Highly self-motivated

- Optimistic

- Self-efficacy

- Visionary

- Non-conformity

- Perform well under pressure

- Ability to make quick decisions

- Emotional resilience

- High levels of emotional energy

- Perseverance and commitment

- Competitive nature

- Dissatisfaction with the status quo

- Willing to take risks

- Belief they can personally make a difference to the world

- Tolerance of ambiguity

While these traits may be positively associated with entrepreneurism, the research does not support the ability to predict which individuals are more likely to be entrepreneurs. These are simply traits frequently found in entrepreneurs in different combinations and levels. However, different studies identify different traits, and trait theory is generally not recognised as a valid approach to the identification of potential entrepreneurs.

3.2 Locus of Control

Locus of control theory examines an individual traits based on their beliefs regarding the way in which rewards or punishments may manifest in their lives. The concept of the locus of control was developed by Rotter. Rotter believed individuals would develop an internal or external perception regarding the main cause of events in their own lives. An internal control orientation indicated an individual believed that their life would be contingent on their own actions and decisions. External control orientation indicated the individual believed external factors beyond their own control, such as luck and fate, are the main influence on events in their lives. Entrepreneurs, along with business owners, often have a higher level of an internal locus of control, indicating there is a greater level of self-belief. This may support several of the traits discussed above, especially the belief individual can make a difference to the world. However, evidence supporting this theory remains weak.

3.3 Need for Achievement Theory

McClelland developed the need for achievement theory, which argues that some individuals have an inherent need to be successful in life, accomplish goals, or achieve recognition. A need for achievement can be a significant motivator for an individual to take action. Many entrepreneurs have a high level of motivation to become successful, which may include financial success, realisation of bringing their ideas to market, or the gaining professional or social recognition as a result of their innovations. Achievement motivation is also positively associated with wheels to take risks and tolerance of ambiguity.

Think of an entrepreneur, for example Richard Baron, Elon Musk, or Levi Roots, what traits do you think they have, and why do you think they became entrepreneurs?

Hint: did they have challenges to overcome, or were there supportive factors in their backgrounds?

4. Nature vs Nurture

Theories concerning the manifestation of entrepreneurship and assessment of traits highlights the debate regarding whether entrepreneurs are born or made; the nature or nurture debate. The research regarding personality trait appears to be weak, and relatively generalised and ambiguous. However, despite the ambiguity of this research, there is some evidence to support various combinations of the identified traits are more likely to be found in entrepreneurs, compared to the general population. Some traits may be argued as the result of nature and personal development. However, many traits, for example risk aversion and optimism, are acquired from a young age, as evidenced with the development theories of Piaget and Erickson. Importantly, these may be shaped and nurtured even during early years as a result of exposure to experiences. As an individual ages, personal experiences also impact on personal traits, especially in the areas of self-efficacy and resilience.

Models dealing with access to resources, including financial resources and social networks, may also be impacted by birth. Different families may have access to different types of resources, such as capital, which may also act on the ability individual to pursue opportunities recognised. However, this is also a matter of nurture rather than nature, as it is the individuals’ response to their surrounding environment, for example influences such as education and business experience.

There are different influences. Nature may provide a basic personality foundation, but this is then shaped and developed as a result of external environmental influences, indicating that nurture may be stronger than nature.

5. Practical Advice

Many individuals may have ideas or recognise opportunities, but not all will become successful entrepreneurs. Even those that start a business may face failure, with recent statistics from the National Office for Statistics indicating up to 40% of start-up businesses may fail within the first five years. Therefore, in addition to having the skills needed to pursue entrepreneurship, it is also necessary to consider practical advice.

5.1 Recognising Opportunities

The first challenge facing potential entrepreneurs may be recognising a viable opportunity. Opportunities need to be recognised and assessed to determine whether or not the opportunity should be pursued. Two different types of opportunity exists; product innovation and process innovation. Product innovation manifests where the entrepreneur identifies a new product. This may be a new feature on an existing product range, a product that fulfils an existing need, or a new product category. A process innovation refers to a new way of undertaking existing production or provision tasks that provide some type of advantage, for example increased efficiency.

To determine whether an idea presents a real opportunity will require research. This may include market research with potential customers to determine whether or not the perceived opportunity is real. Research when assessing the opportunity should also consider the way in which the market currently satisfies the existing needs, examining the potential competing products or services. This will also help to establish the size of the potential market, helping to identify whether or not the opportunity has sufficient value.

Patents searches should also be undertaken, in order to identify if the idea has already been developed and registered in order to prevent later potential legal action.

If an idea is deemed to be a real opportunity, the entrepreneur should develop a business plan.

Get Help With Your Business Assignment

If you need assistance with writing your assignment, our professional business assignment writing service is here to help!

5.2 Importance of the Business Plan

A business plan is a document which presents a plan for the way in which the business will be established and operate. The plan should include the following sections;

- A description of the company, including the legal form of the company such as sole proprietorship or limited company.

- A clear description of the products or services that the company will be selling, with full details regarding the production/provision of services, such as plans for setting up manufacturing, outsourcing. This should also include details regarding the benefits of the product to the potential market and the source of its competitive advantage, the life-cycle of the product, and any relevant details regarding patents, copyrights, or risks associated with trade secrets which cannot be protected.

- A market analysis identifying and quantifying the potential market, including demographic details, and the way in which this market has evolved and may evolve in the future. This section should include verifiable statistics to support any forecasts of expected demand.

- The company’s organisational structure and management team should be identified, along with their relevant expertise that will benefit the company.

- Financial plans should be detailed, including a breakdown of the start-up costs, financial projections/goals based on sales forecasts which should be supported by the market analysis. The financial plan should include forecast income statements, balance statements and cash flow statements as well as the capital expenditure and operating budgets, usually for a period of five years.

Developing business plans facilitate a number of advantages. Firstly, they provide a framework for the entrepreneur to examine their own business idea, and ensure that the opportunity is commercially viable. The plan also lays out the goals of the organisation which may be used to benchmark performance following the initiation of operations. Secondly, the business plan is also likely to be beneficial for capital raising, demonstrating the viability of the business to potential investors/lenders.

5.3 Establishing a Business

There are several ways of establishing a business. For an entrepreneur there are three main legal forms; sole trade, limited company, and partnership. There are advantages and disadvantages to each type of firm.

Table 1; Advantages and disadvantages of different trading forms

|

Legal Form |

Advantages |

Disadvantages |

|

Sole proprietor |

-Easy to set up, merely requires registration with HM Revenue & Customs within 2 months. -Proprietor has sole control of firm -As the firm does not have a separate legal identity all profits and asset belong to the proprietor -Data, including accounting data, remains private -Less onerous accounting requirements |

-As the firm does not have a separate legal identity the proprietor is liable for all debts. -The firm may be perceived as less professional by suppliers/ Customers -Potential difficulties raising finance -The company ceases on the death of the proprietor. |

|

Limited company |

- As the firm has a separate legal identity, the owners are not liable for the firms debts -The firm continues even if an owner dies. -Shares can be sold to raise finance, or used as security for a loan -Limited firms may be perceived as more credible by suppliers and customers. |

-Small cost registering and setting up the firm -Diluted control; shareholders have a say in the running of the firm. -Potential tax advantages for firm retaining profits for reuse, and for payments to shareholders. -Whole shares may be used as security in a firm without a track record, directors may be required to give personal guarantees |

|

Partnership |

-Funding usually comes from all the partners -Sharing of responsibility and decision making between partners -Flexibility in management due to the presence of partners -Partnership does not need to pay corporation tax |

-Each partner has unlimited liability for all of the partnerships debts, so if one partner disappears the remaining partner(s) remain responsible for all the debt. -Tax assessment is based on each individuals personal tax assessment -Disagreements between partners may lead to business break-up |

|

Limited Liability Partnership (LLP) |

-The LLP has a separate legal identity, with partners benefiting from limited liability, only liable for the amount they have contributed to the partnership -Easy to add new partners to the agreement -Rights and responsibilities of the partners can be codified and amended. -Unlimited company, the firm does not need to register as an employer -Unlike limited company, no need for decision making by resolution |

-Less privacy compared to a partnership as accounts are public record. -As income taxed through self-assessment, tax rates on profits may be equal to the higher personal rate. -Gaining equity investment, or raising debt, may be more difficult without a share capital structure. -Must have head office address in UK |

If you were setting up a new business, which structure would you choose at first? Will this change as the business becomes established?

6. Funding and Support

Once the idea is determined to be viable, the entrepreneur will need to look for financing. Different sources of finance are available.

6.1 Bootstrapping

Bootstrapping is the term used when an entrepreneur uses their own resources rather than seeking out external investors. The amount needed may be managed with a number of different strategies. The first source of bootstrapping is owner financing, where the entrepreneur/owner uses the capital they already have. However, with many entrepreneurs lacking sufficient start-up capital, bootstrapping may require additional sources of capital.

In most cases the entrepreneur will also utilise sweat equity. Sweat equity is seen where the entrepreneur invests in the business utilising their own unpaid labour; working without drawing any earnings. The entrepreneur may also benefit from sweat equity provided informally by friends and family.

Strategic management of accounts payable may maximise the capital used by the firm, effectively inserting through using credit provided by suppliers, often delaying bill payment. Likewise, payments due and costs may be reduced in short term by minimising the level of inventories that is held.

The entrepreneur may look to increase capital available to themselves by increasing personal debt, with the funds transferred to the business. As it is personal debt rather than business debt, this is classified as bootstrapping.

Get Help With Your Business Assignment

If you need assistance with writing your assignment, our professional business assignment writing service is here to help!

6.2 External Investors

During the initial setup stages the entrepreneur may be highly reliant on bootstrapping. However, where there is a good business plan, potential assets available for security, or where external investors have faith in the company, external funding may be available.

6.2.1 Angel Investors

Angel investors are private investors, usually utilising private wealth to provide capital for start-up or early-stage entrepreneurial businesses. Investors will usually provide funds in exchange for either an ownership stake, or convertible debt. Traditionally Angels are individuals, although there is a trend towards angel networks, where different angels pool their investments, creating a jointly owned investment portfolio. Angel investors are usually the first external investors for an entrepreneurial company, providing seed funding.

6.2.2 Venture capital

Venture capital is usually the second type of financing obtained by an entrepreneurial business, after the angel financing round. Venture capital investors will often require the company to show a level of successful trading, as proof of concept and viability. However, for particularly robust business plan in desirable sectors, such as technology, where there are advantageous features, such as an entrepreneur with a successful track record, venture capital may be a first line of finance.

Venture capital usually come from a venture fund, which a pooled investment of private investors. Venture capital providers provide funds in return for a date in the company. The motivation of the venture capitalists is to realise a profit as the company grows, so they can sell their stake, often at an IPO, or profiting from a trade sale through merger or acquisition.

6.2.3 Crowdfunding

Crowdfunding is a relatively new source of capital for entrepreneurial firms. Crowdfunding is an alternate form of financing, and is often mediated through an online crowdfunding platform, such as Kick Starter or Indigogo. The company will put forward a proposal, stating the amount of money they wish to raise, and provide an incentive/reward for the investors. A large number of individual and unrelated investors may provide funds in order to gain the rewards, they do not to gain equity. For example, investors may be promised products or services, or a discount on products and services the company is producing in return for investment.

Two types of crowdfunding exist. The first is a ‘keep it all’ model, where a business seeking funding makes an offer through a mediating platform, with potential investors committing to an investment amount. With this ‘keep it all’ model the entrepreneurial business will receive all the investments pledged regardless of whether or not they reach their targeting goal. This provides benefits to the entrepreneurial company, they know they will receive funding that is raised. However, this may also present risk; failing to meet the investment goal may place the company in a difficult position regarding the commitments to provide rewards and insufficient funding to move forward. The alternate model is the all or nothing paradigms, where investors still make pledges, but payment is only taken from investors and passed onto the entrepreneurial companies if target funding requirement is fully met.

6.3 Alternative Sources of Capital

The other alternative sources of capital include hedge funds, which are private investment funds from institutional investors and accredited individuals that make investments in companies they believe have potential. Unlike venture capital funds, these are not limited to only early-stage firms.

Lines of credit from financial institutions such as banks, government, or other businesses may be used. As the company develops a credit history, there may be increased opportunities for loans for the company, based on their trading record. This may be particularly useful where a business has been set up as a limited company, as it is the company, rather than the entrepreneur and shareholders that carry the liability.

7. Summary and Issues in Entrepreneurship

Entrepreneurship is important within the economy, accounting for 60% of all jobs in the private sector, and 47% of private sector revenues earned. Entrepreneurs operate by setting up new businesses based on product or process innovations, which provide a commercial opportunity. The motivations of the entrepreneurs may be financial, but they may also be based on psychological drives, and supported by sociological or anthropological factors. There are a number of traits which appear to be more common in entrepreneurs, such as a permissive attitude towards risk taking, high levels of self-efficacy, and emotional resilience, but other influences impact on whether or not an individual wishes entrepreneurship. This may include access to resources including finance, as well as social support.

Once an entrepreneur has identified an opportunity and decided to set up a business, the opportunity needs to be assessed to ensure that it is viable. This may include market research, but the development of a business plan provides a framework against which the viability may be assessed. In addition, a robust business plan may also help with capital raising. Initial capital raises likely to be bootstrapping, although it is highly likely that additional funding from external investors will be required as the business grows.

Recommended Textbooks

Barringer, B R. (2015). Entrepreneurship. Harlow. Pearson.

Berkery, D. (2007). Raising Venture Capital for the Serious Entrepreneur. London. McGraw-Hill Education

Dyson, J. (2000). Against the Odds: An Autobiography. New York. Texere Publishing

Feld, B. Mendelson, J. and Costolo, D. (2013). Venture Deals: Be Smarter Than Your Lawyer and Venture Capitalist. Hoboken, NJ. John Wiley & Sons

MacIntyre, E. (2014). Business Law. Harlow. Pearson.

Schultz, H, and Yang, D J. (1998). Pour Your Heart into It: How Starbucks Built a Company One Cup at a Time. New York: Hyperion.

Williams, S. (2015). The Financial Times Guide to Business Start Up 2016: The Most Comprehensive Annually Updated Guide for Entrepreneurs. Harlow. Financial Times/Prentice Hall

References

Centre for Enterprise, (2016). Who Makes Money From Entrepreneurship? [Online], Available: http://www.mmucfe.co.uk/what-we-do/research/whomakesmoney [11 September, 2017].

Stevenson, H.H., (1999). The Entrepreneurial Venture. In: H.H. Stevenson, M.J. Roberts, A. Bhide and W.A. Shalman, eds., The Entrepreneurial Venture. Cambridge, MA: Harvard Business Review Press, pp.7-22.

Case Study 1 - Dyson

James Dyson is a serial entrepreneur. Before investing the bagless vacuum clearer, he had developed, and brought to market many other products, including a wheelbarrow (initially called a ballbarrow) with a big ball for a wheel, making it easy to push around corners.

Dysons background may be argued as supporting an entrepreneurial career. James went to Royal College of Art, where he studied design. This gave him the skills required to design new products. It was during the 1970’s that Dyson had the idea for a bagless vacuum cleaner. Dyson noted that the strength of the vacuums ability to pick up dirt was compromised by the presence of the bag, which reduced the suction power as air was sucked through the bag. Therefore, if the bag could be eliminated, the suction power, and therefore the efficiency of the vacuum cleaner could be improved.

Dyson took his idea to the major vacuum manufacturers, but they were not interested; there was a vested interest in retaining the existing models, as the vacuum bag market was worth in excess of £100 million per annum, all revenue which would be lost if consumers no longer needed to buy bags for their vacuums. It is reported that Hoover told Dyson the project was dead from the neck up. With the traditional vacuums able to generate both initial revenues and then ongoing revenues, it is understandable existing firms would resist a disruptive innovation that would eliminate the ongoing revenue streams.

Without the backing of a major firm, Dyson did not have the access to capital from external sources to support bringing the new product to market. This meant Dyson had to look for different ways of financing his investment to bring it to market. This involved bootstrapping; using sweat equality as well as his own capital to build prototypes. In total, 5,127 prototypes were built before the product was fully developed and could be brought to market, which were built by Dyson, experimenting and improving his design.

Without a backer, Dyson had to set up his own company, and started production with only £10,000 capital. The first bagless vacuum, which was called the Cyclon, entered the market place in the UK in 1993 as a result of Dyson pursuing the opportunity and bringing together the aspects of the idea, labour and capital. Initially, the vacuums did not sell well, the incumbents in the business had control over the market and the new vacuums were more expensive and competing firms had larger market share. The marketplace did not have perfect information, with Dyson struggling to gain friction. However, with effective marketing and use of PR Dyson managed to build his brand.

The original Cyclon vacuum cleaner was subsequently improved, and additional items have been developed and brought to market, without the need for the same entrepreneurial stretch, as Dyson had created increased capital from the bagless vacuum cleaner. New products have included the ContraRotator washing machine, which had two drums that rotated in opposite directions, the Airblade hand dryers, fans without external blades, and in 2016 a small hairdryer where the motor is located in the handle to improve balance and reduce the operating noise.

Case Study 2 - Levi Roots

Keith Valentine Graham is better known as Levi Roots. Born in Jamaica, he moved to the UK at age 11. Levi’s background was as a Reggae musician, even being nominated for the Best Reggae Act in the 1998 MOBO awards. However, it was his Jamaican inspired jerk sauce that lead to his entrepreneurial activities.

Levi developed a new product; Reggae sauce. This was developed by Levi, Who managed to sell 4,000 bottles at the 2006 Notting Hill Carnival. Levi was pursuing his idea and selling bottles on his own stall, and seeking out new opportunities. However, he had limited capital and resources. His main source of capital was initially bootstrapping, using his own sweat equity. But he was also recycling money earned from sales to support future sales.

After taking the sauce to a trade show, Levi was approached by a BBC producer who believed that the product would do well on the BBC television program Dragons Den. Dragons Den is a series in which budding entrepreneurs pitch their business ideas to potential investors with the aim of gaining venture capital and potential practical advice. This facilities the potential for entrepreneurs to miss out the need for an angel investor and move straight to venture capital investors. To allow an equity stake to be acquired by the investor, the business has usually moved, or will move to, the limited status.

Levi appeared on Dragons Den on the 7th of February 2007. He obtained an investment of £50,000 for a 40% stake in his business. Levi’s pitch on the program was inaccurate, as he claimed he had a total of 2.5 million bottles of sauce on order, when it was actually 2,500 kilos. However, despite this mistake, the investment by Peter Jones and Richard Farleigh went ahead.

The benefits from the investment was not only financial. They included the business experience of the investors, which supported marketing, as well as providing resources, such as access to business decision makers. Shortly after the program, Levi released an extended version of the Reggae Sauce song he performed on Dragons Den, and Sainsbury’s announced an exclusive deal to stock the sauce. By 2010 the value of the brand was estimated to be $30 million by The Grocer Magazine. The sauce was being sold at most main supermarkets, and the brand had expanded though related diversification, being used in a range of ready meals. In 2011, Domino’s Pizzas launched a special edition Reggae Pizza, Morrison’s supermarket launched a Reggae Reggae sandwich, and KFC sold a Reggea Reggae Box Meal.

Though the investment and support that enables the brand to grow, the product, and the firm, have moved from entrepreneurial to a main stream firm.

Cite This Module

To export a reference to this article please select a referencing style below:

Related Content

CollectionsContent relating to: "Entrepreneurship"

Entrepreneurship refers to using innovation to identify and set up a business to leverage a business opportunity. An entrepreneur will take advantage of their entrepreneurial mindset to capitalise on opportunities that arise.

Related Articles

What is Entrepreneurship? Lecture Notes

Entrepreneurship refers to the process of identifying, and then setting up a business to leverage a business opportunity. The entrepreneurial......

Mark Zuckerberg Entrepreneur Characteristics

Facebook, the well-known online social networking website was begun at the college campus of Harvard University in 2004. In just a short period of time, it has attained immense recognition among Ameri...

Exploration of the Entrepreneurial Mindset

In this assignment I discuss about exploration of Entrepreneurial Mindset. As we discuss here the characteristics and traits of Entrepreneurial and also we discuss here differentiate between managers and entrepreneurial....

GBR

GBR